The Hierarchy of Money

A few years ago the lectures from economist professor Perry Merhling popped into my YouTube feed. This was just after I had finished reading Capital in the Twenty-First Century which had opened my eyes to wealth inequality, when I first started asking the questions of how money actually works.

Merhling explains money in a very simple manner. It is a hierarchy.

At the top is real money. For thousands of years that was gold. Gold was accepted anywhere in the world. Coins used to have a value based on the gold, silver, and copper content in the coin. That top layer went away in the 1970s when the US left the gold standard behind.

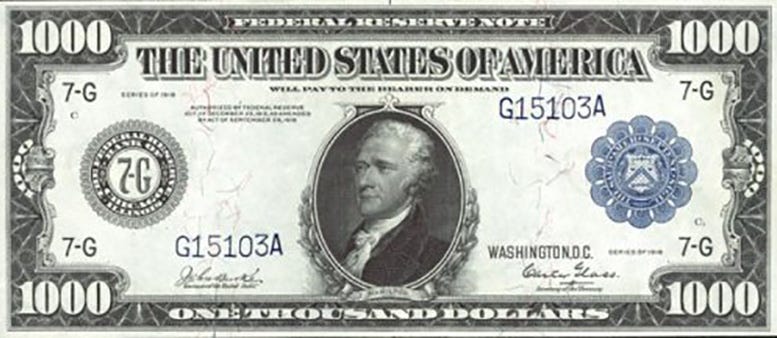

The next layer down is paper money. For hundreds of years paper money was a promise by banks and government to deliver gold. You used to be able to walk into a bank and trade a $20 bill for a $20 gold coin. Today the dollar bills (and other currencies) are the “real” money, which in the end is just fine as stores accept paper money for goods and service providers accept paper money for services.

Next we have bank deposits. Bank deposits are not money. Bank deposits are a promise by the bank to give you money when you ask for it. Normally, when all is well, those promises are kept and bank deposits are as good as money. So much so that we don’t usually actually pay for goods and service with paper money, we pay with bank deposits.

Checks are just orders to the bank to move around bank deposits. Debit cards are checks without the paper. And until the balance is due, credit cards are bank deposits paid by your card provider to the vendors, which automatically turn into loans the day after the bill is due.

Moving down another layer, bank loans, corporate debt, and government debt are promises to pay your bank deposits. And the hierarchy continues downward with derivaties like mortgage backed securities, aggregating morgage debt into a promise to pay based on the promises of the mortages to pay.

lunarmobiscuit.com/what-is-money has a bit more detail on this topic, and lunarmobiscuit.com/category/economics has quite a few posts on economics explained by a well-red but untrained amateur economist.