An explanation of how supply and demand changes prices can be found in Adam Smith’s, The Wealth of Nations, published in 1776. When supply is insufficient to meet demand, prices rise. When demand drops below supply, prices drop.

This simple theory has proven true for hundreds of years. It is a core lesson of microeconomics. Obvious true, no?

Apparently not, at least when it comes to the housing market. I’ve twice attended meetings at my local City Hall where elected member of the City Council have said, in public, that adding housing to my community will not lower prices.

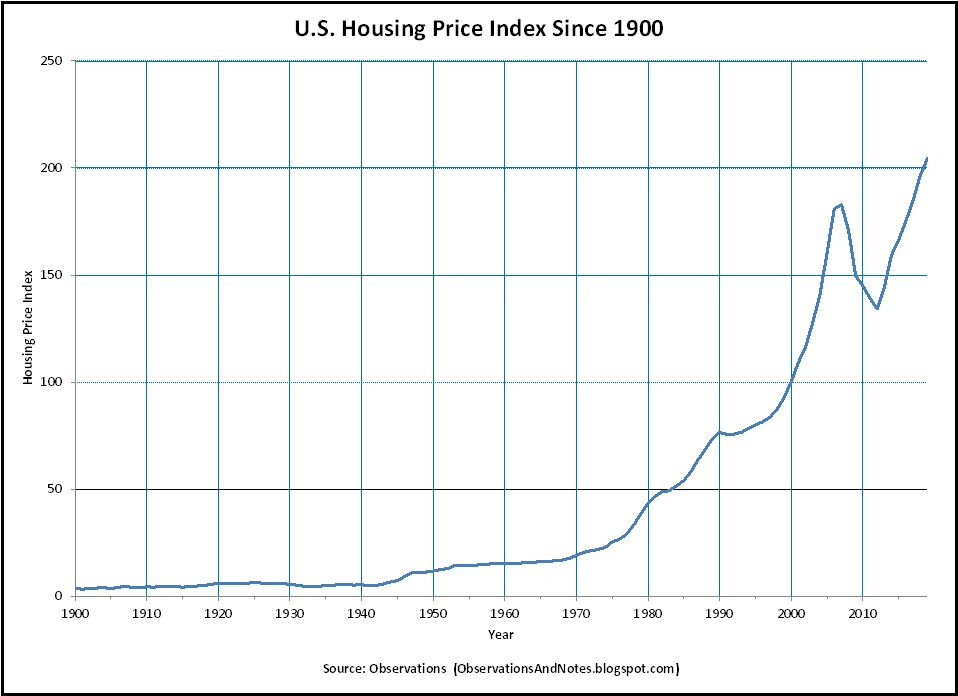

I’m not one to be quiet and shy at those meetings, and questioned why they thought the rule of supply and demand did not apply to houses. Both times their answers were that housing prices only go up, no matter the supply. Both times I pointed out such statements were false, proven true by the large drop in housing prices during the Panic of 2008, then again at the start of the pandemic. Both of those moments when I lived in this community. Both of those moments when the number of buyers dropped precipitously, creating a glut of homes for sale. A.k.a. supply in excess of demand.

Yes, housing prices have almost always gone up. Above is a housing price index dating back 120 years.

What else has almost always risen in that same 120 year period? Population.

Every one of those people needs to live somewhere. The supply of homes can be a mix of owners and renters. That doesn’t matter. What matters is whether the supply of homes is keeping up with the demand of homes from the growing population.

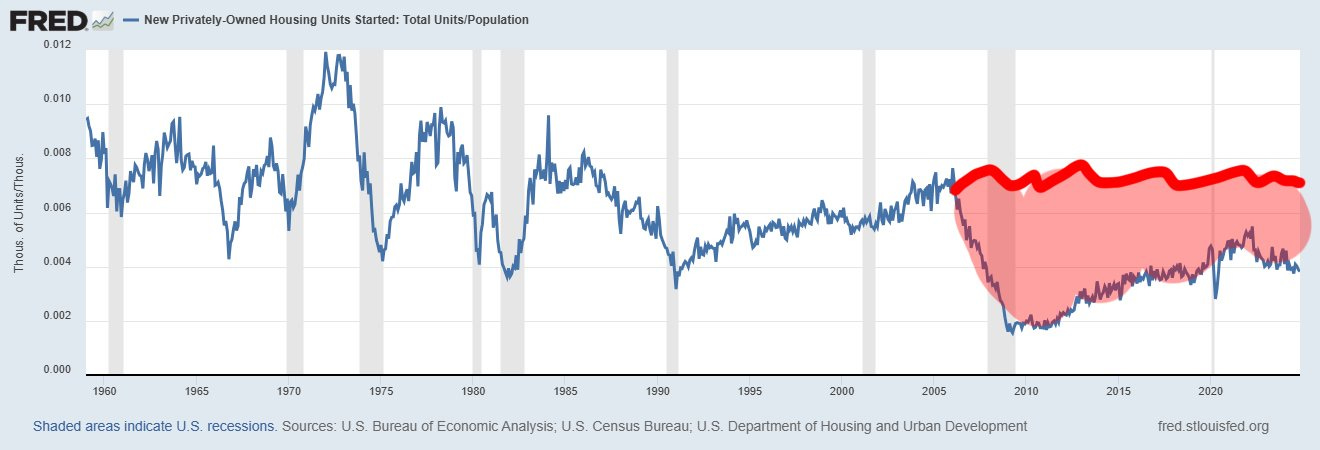

The Federal government tracks housing starts, as in the number of new homes built each month. FRED is an online database with this and hundreds of other statistics gathered by the Federal government.

In the above graph, the blue line is from FRED. That root cause of the Panic in 2008 was a housing bubble. It seems the builders noticed the underlying issue before the banks and slowed down the housing starts before the crash.

The red line and area is something I found in a tweet. This is roughly the number of houses that were not built in the last 20 years. Actually, it is hard to read the title but this graph is not the raw number of housing starts, it is instead the ratio of housing starts to U.S. population.

We as a country are thus not only still building fewer homes per year than in the 1960s, 1970s, and 1980s, we are building fewer homes per family.

Supply is greatly exceeding demand. Especially in the cities with the fastest growing economies, which are growing because they are creating jobs that are filled by incoming migrants.

Communities like where I live, where the median home now costs well over $1 million. A price is that has almost tripled since I moved here in 2002.

Sorry City Council, but Adam Smith’s theories apply to housing too. Housing prices change more slowly than eggs, but there is nothing sufficiently differnt about the housing market to change the fundamentals of economics.

Audra and I agree, "Supply is greatly exceeding demand." is not what we believe you intended to say. Reverse?

Your last statement that supply exceeds demand seems wrong to what you’re saying, isn’t it demand exceeds supply?